Page 186 - Hong Kong Housing Society Annual Report 2023/24

P. 186

2.4 Material accounting policies (continued) 2.4 重大會計政策 (續)

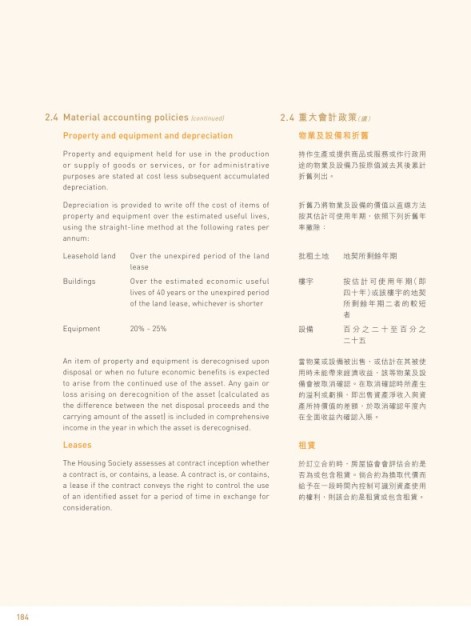

Property and equipment and depreciation 物業及設備和折舊

Property and equipment held for use in the production 持作生產或提供商品或服務或作行政用

or supply of goods or services, or for administrative 途的物業及設備乃按原值減去其後累計

purposes are stated at cost less subsequent accumulated 折舊列出。

depreciation.

Depreciation is provided to write off the cost of items of 折舊乃將物業及設備的價值以直線方法

property and equipment over the estimated useful lives, 按其估計可使用年期,依照下列折舊年

using the straight-line method at the following rates per 率撇除:

annum:

Leasehold land Over the unexpired period of the land 批租土地 地契所剩餘年期

lease

Buildings Over the estimated economic useful 樓宇 按估計可使用年期(即

lives of 40 years or the unexpired period 四十年)或該樓宇的地契

of the land lease, whichever is shorter 所剩餘年期二者的較短

者

Equipment 20% - 25% 設備 百分之二十至百分之

二十五

An item of property and equipment is derecognised upon 當物業或設備被出售,或估計在其被使

disposal or when no future economic benefits is expected 用時未能帶來經濟收益,該等物業及設

to arise from the continued use of the asset. Any gain or 備會被取消確認。在取消確認時所產生

loss arising on derecognition of the asset (calculated as 的溢利或虧損,即出售資產淨收入與資

the difference between the net disposal proceeds and the 產所持價值的差額,於取消確認年度內

carrying amount of the asset) is included in comprehensive 在全面收益內確認入賬。

income in the year in which the asset is derecognised.

Leases 租賃

The Housing Society assesses at contract inception whether 於訂立合約時,房屋協會會評估合約是

a contract is, or contains, a lease. A contract is, or contains, 否為或包含租賃。倘合約為換取代價而

a lease if the contract conveys the right to control the use 給予在一段時間內控制可識別資產使用

of an identified asset for a period of time in exchange for 的權利,則該合約是租賃或包含租賃。

consideration.

184