Page 231 - Hong Kong Housing Society Annual Report 2023/24

P. 231

AUDITED FINANCIAL STATEMENTS 已審核財務報表

NOTES TO THE FINANCIAL STATEMENTS 財務報表附註

14. Loans receivable (continued) 14. 應收貸款 (續)

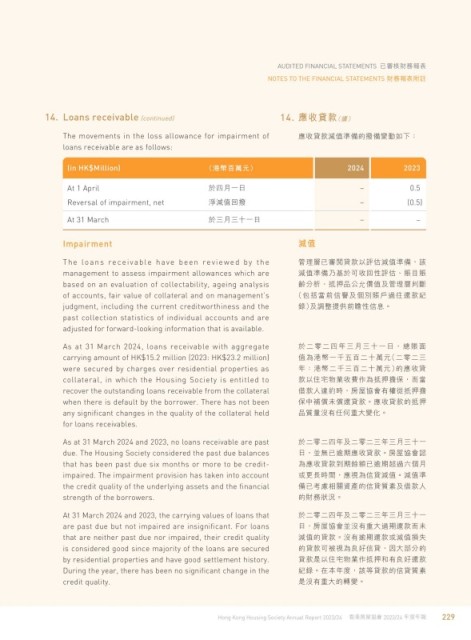

The movements in the loss allowance for impairment of 應收貸款減值準備的撥備變動如下:

loans receivable are as follows:

(in HK$Million) (港幣百萬元) 2024 2023

At 1 April 於四月一日 – 0.5

Reversal of impairment, net 淨減值回撥 – (0.5)

At 31 March 於三月三十一日 – –

Impairment 減值

The loans receivable have been reviewed by the 管理層已審閱貸款以評估減值準備,該

management to assess impairment allowances which are 減值準備乃基於可收回性評估、賬目賬

based on an evaluation of collectability, ageing analysis 齡分析、抵押品公允價值及管理層判斷

of accounts, fair value of collateral and on management’s (包括當前信譽及個別賬戶過往還款紀

judgment, including the current creditworthiness and the 錄)及調整提供前瞻性信息。

past collection statistics of individual accounts and are

adjusted for forward-looking information that is available.

As at 31 March 2024, loans receivable with aggregate 於二零二四年三月三十一日,總賬面

carrying amount of HK$15.2 million (2023: HK$23.2 million) 值為港幣一千五百二十萬元(二零二三

were secured by charges over residential properties as 年:港幣二千三百二十萬元)的應收貸

collateral, in which the Housing Society is entitled to 款以住宅物業收費作為抵押擔保,而當

recover the outstanding loans receivable from the collateral 借款人違約時,房屋協會有權從扺押擔

when there is default by the borrower. There has not been 保中補償未償還貸款。應收貸款的抵押

any significant changes in the quality of the collateral held 品質量沒有任何重大變化。

for loans receivables.

As at 31 March 2024 and 2023, no loans receivable are past 於二零二四年及二零二三年三月三十一

due. The Housing Society considered the past due balances 日,並無已逾期應收貸款。房屋協會認

that has been past due six months or more to be credit- 為應收貸款到期餘額已逾期超過六個月

impaired. The impairment provision has taken into account 或更長時間,應視為信貸減值。減值準

the credit quality of the underlying assets and the financial 備已考慮相關資產的信貸質素及借款人

strength of the borrowers. 的財務狀況。

At 31 March 2024 and 2023, the carrying values of loans that 於二零二四年及二零二三年三月三十一

are past due but not impaired are insignificant. For loans 日,房屋協會並沒有重大過期還款而未

that are neither past due nor impaired, their credit quality 減值的貸款。沒有逾期還款或減值損失

is considered good since majority of the loans are secured 的貸款可被視為良好信貸,因大部分的

by residential properties and have good settlement history. 貸款是以住宅物業作抵押和有良好還款

During the year, there has been no significant change in the 紀錄。在本年度,該等貸款的信貸質素

credit quality. 是沒有重大的轉變。

Hong Kong Housing Society Annual Report 2023/24 香港房屋協會 2023/24 年度年報 229