Page 166 - Hong Kong Housing Society 香港房屋協會 - Annual Report 2019 年報

P. 166

164 audited Financial Statements 已審核財務報表

NOtES tO tHE FiNANCiAl StAtEMENtS

財務報表附註

5. Financial risk management objectives and 5. 財務風險管理目標及政策(續)

policies (continued)

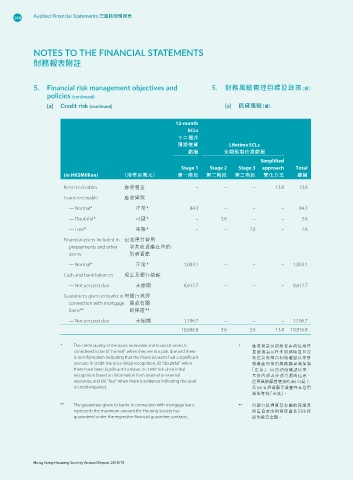

(a) Credit risk (continued) (a) 信貸風險(續)

12-month

ECLs

十二個月

預期信貸 Lifetime ECLs

虧損 全期預期信貸虧損

Simplified

Stage 1 Stage 2 Stage 3 approach Total

(in HK$Million) (港幣百萬元) 第一階段 第二階段 第三階段 簡化方法 總額

Rent receivables 應收租金 – – – 13.8 13.8

Loans receivable 應收貸款

— Normal* — 正常* 84.3 – – – 84.3

— Doubtful* — 可疑* – 3.6 – – 3.6

— Loss* — 呆賬* – – 2.6 – 2.6

Financial assets included in 包含預付費用

prepayments and other 和其他資產在內的

assets 財務資產

— Normal* — 正常* 1,003.1 – – – 1,003.1

Cash and bank balances 現金及銀行結餘

— Not yet past due — 未逾期 8,612.7 – – – 8,612.7

Guarantees given to banks in 與銀行抵押

connection with mortgage 貸款有關

loans** 的保證**

— Not yet past due — 未逾期 1,196.7 – – – 1,196.7

10,896.8 3.6 2.6 13.8 10,916.8

* The credit quality of the loans receivable and financial assets is * 應收貸款及財務資產的信用質

considered to be (i) “normal” when they are not past due and there 量被視為 (i)在未到期時並且沒

is no information indicating that the financial assets had a significant 有信息表明自初始確認以來財

increase in credit risk since initial recognition; (ii) “doubtful” when 務資產的信用風險顯著增加為

there have been significant increases in credit risk since initial 「正常」;(ii) 自初始確認以來,

recognition based on information from internal or external 基於內部或外部資源的信息,

resources; and (iii) “loss” when there is evidence indicating the asset 信用風險顯著增加時為「可疑」;

is credit-impaired. 及 (iii) 有證據顯示資產存在信用

減值時為「呆賬」。

** The guarantees given to banks in connection with mortgage loans ** 與銀行抵押貸款有關的保證是

represents the maximum amount the Housing Society has 房屋協會的財務保證合同所保

guaranteed under the respective financial guarantee contracts. 證的最高金額。

Hong Kong Housing Society Annual Report 2018/19