Page 213 - Hong Kong Housing Society Annual Report 2023/24

P. 213

AUDITED FINANCIAL STATEMENTS 已審核財務報表

NOTES TO THE FINANCIAL STATEMENTS 財務報表附註

5. Financial risk management objectives and 5. 財務風險管理目標及政策 (續)

policies (continued)

(c) Market risk (continued) (c) 市場風險 (續)

(ii) Price risk (ii) 價格風險

The Housing Society is exposed to price risk 房屋協會面對價格風險是由

arising from investment related financial 有關投資的財務資產及負債

assets and liabilities. This risk is controlled and 產生,此風險是由資產分配

monitored by asset allocation limit. 限額來監控的。

Sensitivity analysis 敏感度分析

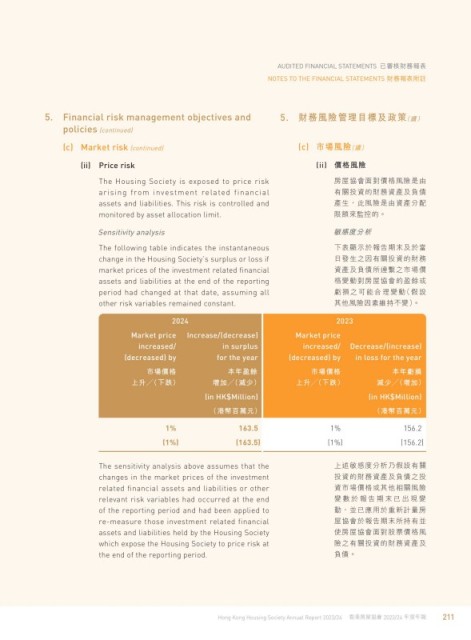

The following table indicates the instantaneous 下表顯示於報告期末及於當

change in the Housing Society’s surplus or loss if 日發生之因有關投資的財務

market prices of the investment related financial 資產及負債所連繫之市場價

assets and liabilities at the end of the reporting 格變動對房屋協會的盈餘或

period had changed at that date, assuming all 虧損之可能合理變動(假設

other risk variables remained constant. 其他風險因素維持不變)。

2024 2023

Market price Increase/(decrease) Market price

increased/ in surplus increased/ Decrease/(increase)

(decreased) by for the year (decreased) by in loss for the year

市場價格 本年盈餘 市場價格 本年虧損

上升╱(下跌) 增加╱(減少) 上升╱(下跌) 減少╱(增加)

(in HK$Million) (in HK$Million)

(港幣百萬元) (港幣百萬元)

1% 163.5 1% 156.2

(1%) (163.5) (1%) (156.2)

The sensitivity analysis above assumes that the 上述敏感度分析乃假設有關

changes in the market prices of the investment 投資的財務資產及負債之投

related financial assets and liabilities or other 資市場價格或其他相關風險

relevant risk variables had occurred at the end 變數於報告期末已出現變

of the reporting period and had been applied to 動,並已應用於重新計量房

re-measure those investment related financial 屋協會於報告期末所持有並

assets and liabilities held by the Housing Society 使房屋協會面對股票價格風

which expose the Housing Society to price risk at 險之有關投資的財務資產及

the end of the reporting period. 負債。

Hong Kong Housing Society Annual Report 2023/24 香港房屋協會 2023/24 年度年報 211