Page 214 - Hong Kong Housing Society Annual Report 2023/24

P. 214

5. Financial risk management objectives and 5. 財務風險管理目標及政策 (續)

policies (continued)

(c) Market risk (continued) (c) 市場風險 (續)

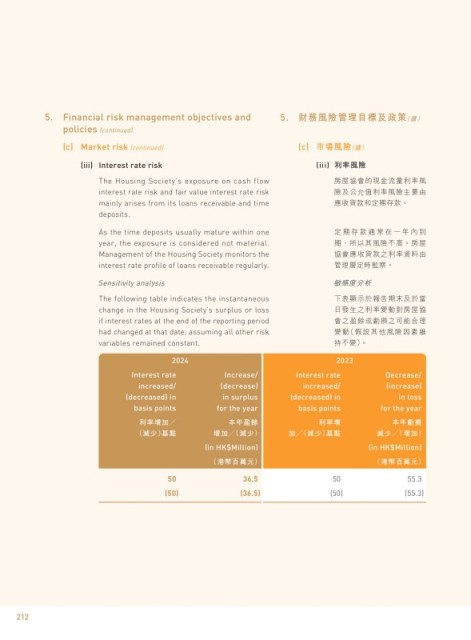

(iii) Interest rate risk (iii) 利率風險

The Housing Society’s exposure on cash flow 房屋協會的現金流量利率風

interest rate risk and fair value interest rate risk 險及公允值利率風險主要由

mainly arises from its loans receivable and time 應收貸款和定期存款。

deposits.

As the time deposits usually mature within one 定期存款通常在一年內到

year, the exposure is considered not material. 期,所以其風險不高。房屋

Management of the Housing Society monitors the 協會應收貸款之利率資料由

interest rate profile of loans receivable regularly. 管理層定時監察。

Sensitivity analysis 敏感度分析

The following table indicates the instantaneous 下表顯示於報告期末及於當

change in the Housing Society’s surplus or loss 日發生之利率變動對房屋協

if interest rates at the end of the reporting period 會之盈餘或虧損之可能合理

had changed at that date, assuming all other risk 變動(假設其他風險因素維

variables remained constant. 持不變)。

2024 2023

Interest rate Increase/ Interest rate Decrease/

increased/ (decrease) increased/ (increase)

(decreased) in in surplus (decreased) in in loss

basis points for the year basis points for the year

利率增加╱ 本年盈餘 利率增 本年虧損

(減少)基點 增加╱(減少) 加╱(減少)基點 減少╱(增加)

(in HK$Million) (in HK$Million)

(港幣百萬元) (港幣百萬元)

50 36.5 50 55.3

(50) (36.5) (50) (55.3)

212