Page 218 - Hong Kong Housing Society Annual Report 2023/24

P. 218

5. Financial risk management objectives and 5. 財務風險管理目標及政策 (續)

policies (continued)

(d) Financial assets and liabilities measured at (d) 財務資產及負債按公允價值

fair value (continued) 計量 (續)

Valuation techniques and inputs used in Level 1 第一級及第二級公允價值計量

and Level 2 fair value measurements (continued) 所使用之估值方法及數據 (續)

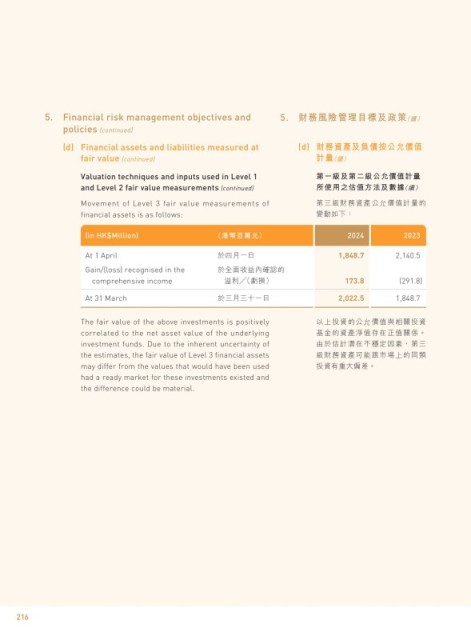

Movement of Level 3 fair value measurements of 第三級財務資產公允價值計量的

financial assets is as follows: 變動如下:

(in HK$Million) (港幣百萬元) 2024 2023

At 1 April 於四月一日 1,848.7 2,140.5

Gain/(loss) recognised in the 於全面收益內確認的

comprehensive income 溢利╱(虧損) 173.8 (291.8)

At 31 March 於三月三十一日 2,022.5 1,848.7

The fair value of the above investments is positively 以上投資的公允價值與相關投資

correlated to the net asset value of the underlying 基金的資產淨值存在正值關係。

investment funds. Due to the inherent uncertainty of 由於估計潛在不穩定因素,第三

the estimates, the fair value of Level 3 financial assets 級財務資產可能跟市場上的同類

may differ from the values that would have been used 投資有重大偏差。

had a ready market for these investments existed and

the difference could be material.

216