Page 172 - Hong Kong Housing Society 香港房屋協會 - Annual Report 2019 年報

P. 172

170 audited Financial Statements 已審核財務報表

NOtES tO tHE FiNANCiAl StAtEMENtS

財務報表附註

5. Financial risk management objectives and 5. 財務風險管理目標及政策(續)

policies (continued)

(d) Financial assets and liabilities measured at fair (d) 財務資產及負債按公允價值

value (continued) 計量 (續)

Fair value hierarchy (continued) 公允價值等級(續)

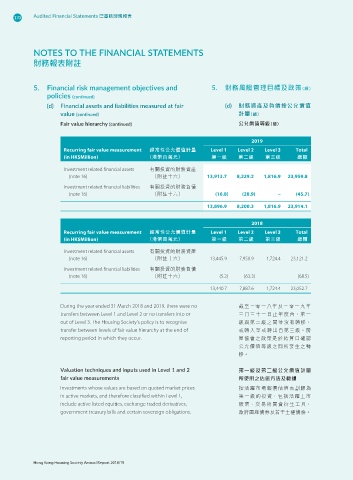

2019

Recurring fair value measurement 經常性公允價值計量 Level 1 Level 2 Level 3 Total

(in HK$Million) (港幣百萬元) 第一級 第二級 第三級 總額

Investment related financial assets 有關投資的財務資產

(note 16) (附註十六) 13,913.7 8,229.2 1,816.9 23,959.8

Investment related financial liabilities 有關投資的財務負債

(note 16) (附註十六) (16.8) (28.9) – (45.7)

13,896.9 8,200.3 1,816.9 23,914.1

2018

Recurring fair value measurement 經常性公允價值計量 Level 1 Level 2 Level 3 Total

(in HK$Million) (港幣百萬元) 第一級 第二級 第三級 總額

Investment related financial assets 有關投資的財務資產

(note 16) (附註十六) 13,445.9 7,950.9 1,724.4 23,121.2

Investment related financial liabilities 有關投資的財務負債

(note 16) (附註十六) (5.2) (63.3) – (68.5)

13,440.7 7,887.6 1,724.4 23,052.7

During the year ended 31 March 2018 and 2019, there were no 截至二零一八年及二零一九年

transfers between Level 1 and Level 2 or no transfers into or 三月三十一日止年度內,第一

out of Level 3. The Housing Society’s policy is to recognise 級與第二級之間並沒有轉移,

transfer between levels of fair value hierarchy at the end of 或轉入至或轉出自第三級。房

reporting period in which they occur. 屋協會之政策是於結算日確認

公允價值等級之間所發生之轉

移。

valuation techniques and inputs used in level 1 and 2 第一級及第二級公允價值計量

fair value measurements 所使用之估值方法及數據

Investments whose values are based on quoted market prices 按活躍市場報價估值而劃歸為

in active markets, and therefore classified within Level 1, 第一級的投資,包括活躍上市

include active listed equities, exchange traded derivatives, 股票、交易所買賣衍生工具、

government treasury bills and certain sovereign obligations. 政府國庫債券及若干主權債務。

Hong Kong Housing Society Annual Report 2018/19